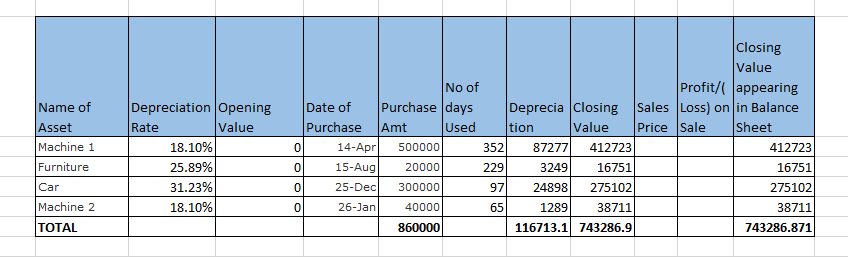

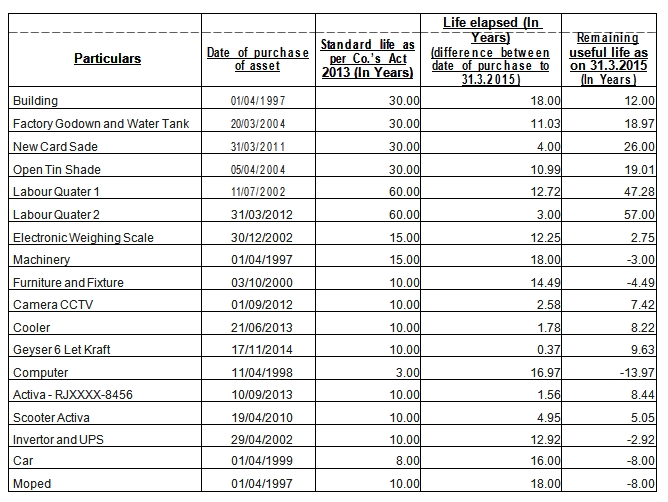

Depreciation Format In Excel As Per Companies Act 2013 WEB May 24 2021 nbsp 0183 32 Calculation of Depreciation and WDV from Fin Year 2015 2016 to Fin Year 2021 22 2 Facility to calculate Depreciation based on useful live as per Schedule II to Companies Act 2013 or as per the own estimation of the User

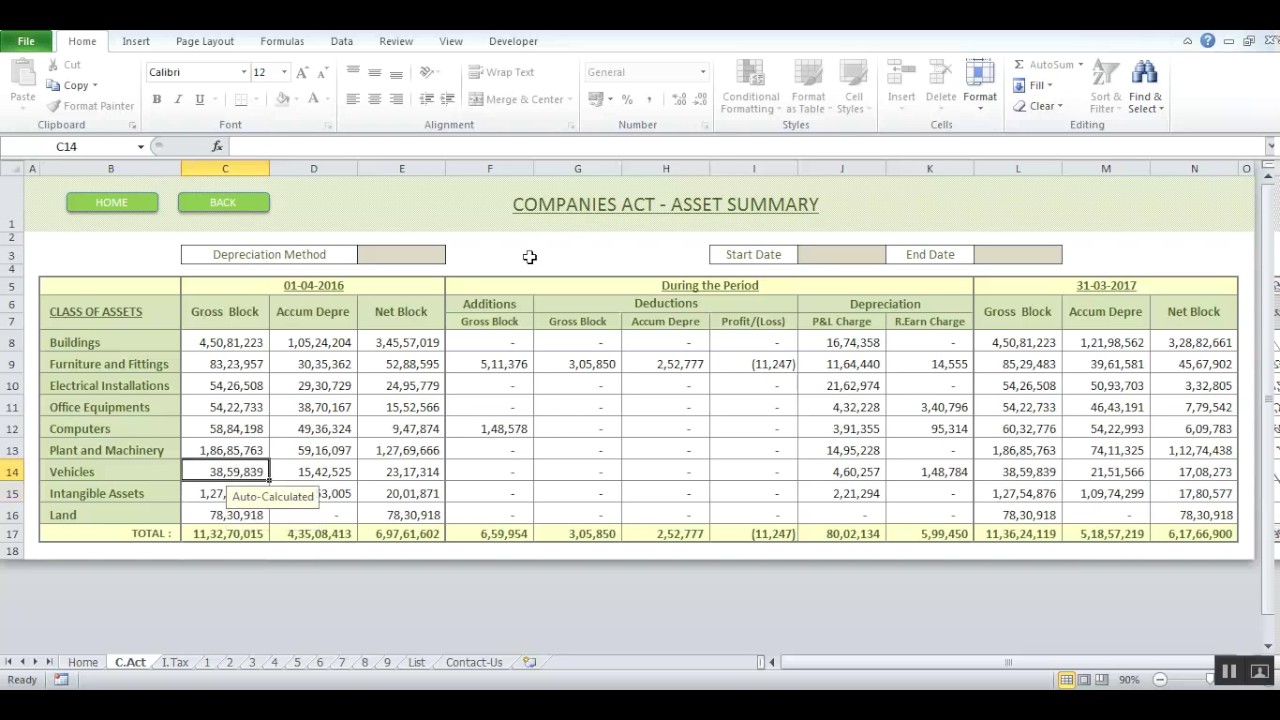

WEB Aug 5 2015 nbsp 0183 32 Automated excel utility for calculating depreciation as per Companies Act 2013 Schedule II Features of the utility 1 It can calculate individual asset WDV as on 01 04 2014 as well as current year depreciation WEB Apr 1 2014 nbsp 0183 32 Excel Format Depreciation Calculator under Companies Act 2013 Schedule II Supports WDV SLM Method Double Triple Shift Working Version 15 50 Download

Depreciation Format In Excel As Per Companies Act 2013

Depreciation Format In Excel As Per Companies Act 2013

https://absamad.files.wordpress.com/2016/05/as10020416.jpg?w=584

How To Calculate Depreciation As Per Companies ACT 2013 Depreciation

https://i.ytimg.com/vi/B06-w2YI6Rg/maxresdefault.jpg

Beautiful Fixed Asset Register Format In Excel As Per Companies Act

https://i.ytimg.com/vi/WztFuBxjBUo/maxresdefault.jpg

WEB Jun 4 2023 nbsp 0183 32 There are three methods to calculate depreciation as per companies act 2013 Straight line Method SLM The asset is depreciated equally every year over the useful life of the asset as a percentage of the Initial Cost WEB Jun 21 2016 nbsp 0183 32 Depreciation Calculator as per Companies Act 2013 in Excel SELF MADE DEPRECIATION CHART EASY TO OPERATE NO FORMULAS HIDDEN SO ONE CAN ALSO DERIVE A BETTER CHART FROM THIS THIS IS MY ATTEMPT AS A STUDENT xls

WEB Apr 20 2019 nbsp 0183 32 Using this excel first time you can enter opening balances Gross Block Accumulated depreciation to make transition easier Depreciation can also be computed in case of revaluation of assets receipt of subsidy with prospective effect example is explained in excel file WEB Jun 15 2024 nbsp 0183 32 Calculate depreciation under the Companies Act 2013 Learn how to use the WDV method and find useful life for your assets in Schedule II

More picture related to Depreciation Format In Excel As Per Companies Act 2013

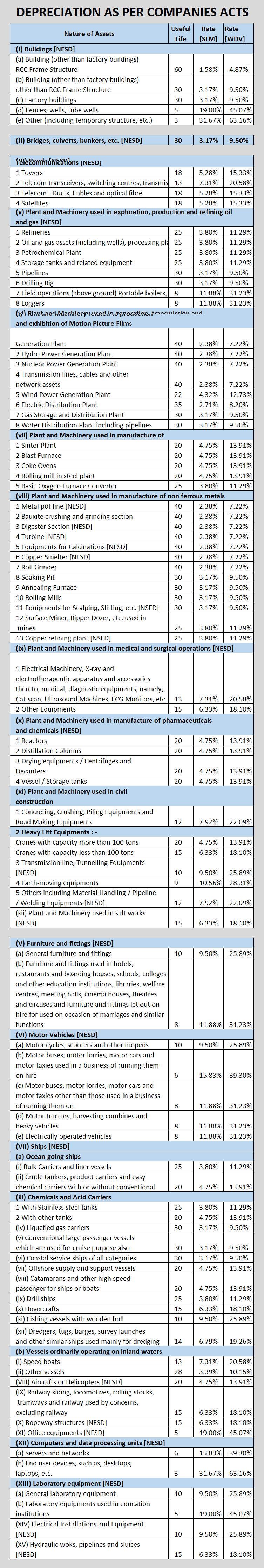

Depreciation As Per Companies Act Assignment Depreciation Chart

https://d1avenlh0i1xmr.cloudfront.net/4ea87d35-e05b-4383-9c8e-c46d76c642e9/10.png

Depreciation Rates Chart Under Companies Act 2013

https://www.alerttax.in/wp-content/uploads/2017/08/DEPRICIATION-RATES-AS-PER-COMPANIES-ACT.png

Fabulous Schedule Iii Of Companies Act 2013 Excel Exce Templates Profit

http://3.bp.blogspot.com/-cfkutAQ_Uss/VoOi-kMXM5I/AAAAAAAAH8Q/3xw07om4FY4/s1600/Part%2BC%2Bof%2BSchedule%2BII%2Bto%2Bcompanies%2BAct%252C%2B2013.jpg

WEB The depreciation charged as an expense in the Profit amp Loss A c helps compensate the company for the value lost on the depreciable assets Depreciable assets are those assets that are used for the purpose of business which can be depreciated WEB This document provides depreciation schedules for various assets as per Schedule II of the Companies Act 2013 It includes depreciation rates and useful lives for buildings plant and machinery furniture and fittings vehicles aircraft ships computers and other assets

WEB ABCAUS Excel Companies Act 2013 Depreciation V 1 50 Calculator For FY 2015 16 What s new in version 1 50 In the new version 1 50 an error showing incorrect depreciation for SLM purpose have been corrected WEB Depreciation Calculator as per Companies Act 2013 Date of Purchase of Asset Cost of Acquisition No of years to write off Residual Value Method of Calculation WDV SLM Reset Depreciation

Depreciation Automatic Calculator As Per Companies Act 2013

http://4.bp.blogspot.com/-dKSj6V-c1HA/VchivyE9nJI/AAAAAAAACBc/GH-TLLUM754/s1600/Depreciation%2BAutomatic%2BCalculator%2Bas%2Bper%2BCompanies%2BAct%2B2013.png

Depreciation Chart As Per Companies Act 2013 For FY 18 19

https://studycafe.in/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2018/12/machine.png

Depreciation Format In Excel As Per Companies Act 2013 - {WEB Oct 7 2020 nbsp 0183 32 Depreciation Calculator for Companies Act 2013 Depreciation as per companies act 2013 for Financial year 2014 15 and thereafter These provisions are applicable from 01 04 2014 vide notification dated 27 03 2014 Depreciation is calculated by considering useful life of asset cost and residual value Any method WDV or SLM can be |WEB The document discusses depreciation methods and calculations for different assets Method 1 calculates depreciation assuming a residual value of zero while Method 2 uses the written down value method assuming a 5 residual value | WEB Excel Format Depreciation Calculator for Single or Extra Double Triple Shift Basis and WDV SLM Method under Companies Act 2013 Schedule II Download | WEB Jun 4 2023 nbsp 0183 32 There are three methods to calculate depreciation as per companies act 2013 Straight line Method SLM The asset is depreciated equally every year over the useful life of the asset as a percentage of the Initial Cost | WEB Jun 21 2016 nbsp 0183 32 Depreciation Calculator as per Companies Act 2013 in Excel SELF MADE DEPRECIATION CHART EASY TO OPERATE NO FORMULAS HIDDEN SO ONE CAN ALSO DERIVE A BETTER CHART FROM THIS THIS IS MY ATTEMPT AS A STUDENT xls | WEB Apr 20 2019 nbsp 0183 32 Using this excel first time you can enter opening balances Gross Block Accumulated depreciation to make transition easier Depreciation can also be computed in case of revaluation of assets receipt of subsidy with prospective effect example is explained in excel file | WEB Jun 15 2024 nbsp 0183 32 Calculate depreciation under the Companies Act 2013 Learn how to use the WDV method and find useful life for your assets in Schedule II }