Depreciation Format In Excel Web This page is the first of a 3 part series covering Depreciation in Excel Part 1 provides a Depreciation Schedule for financial reporting and explains the formulas used for the basic common depreciation methods Part 2

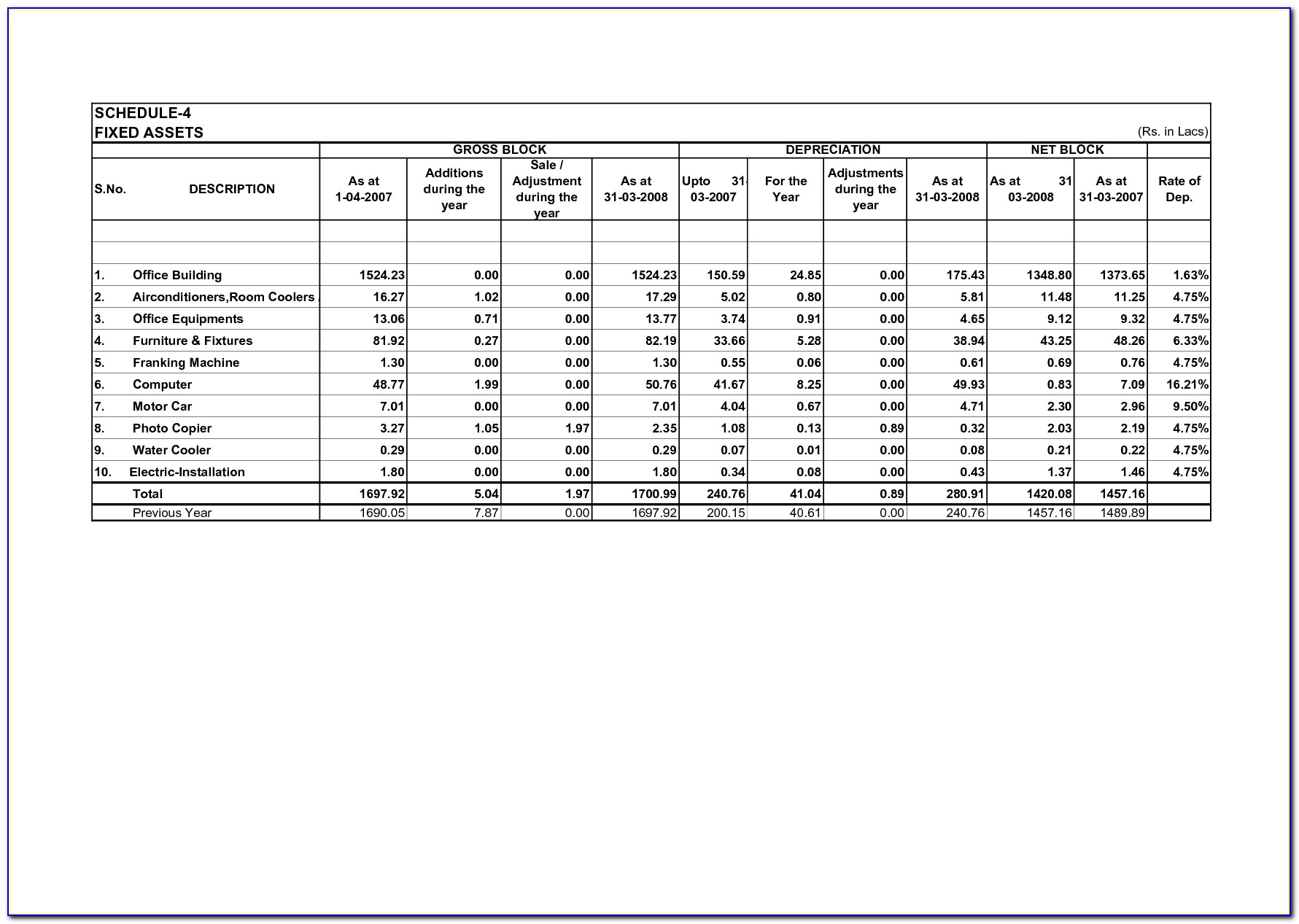

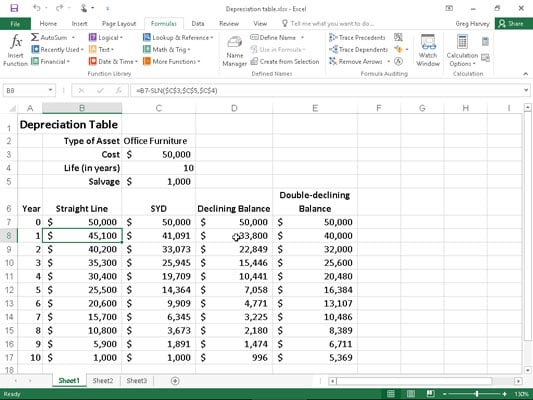

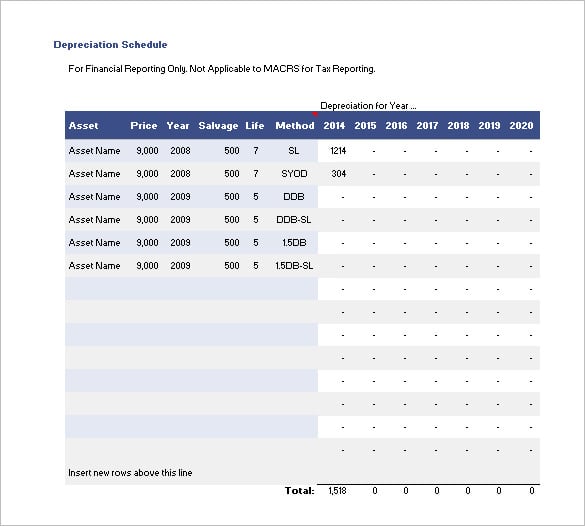

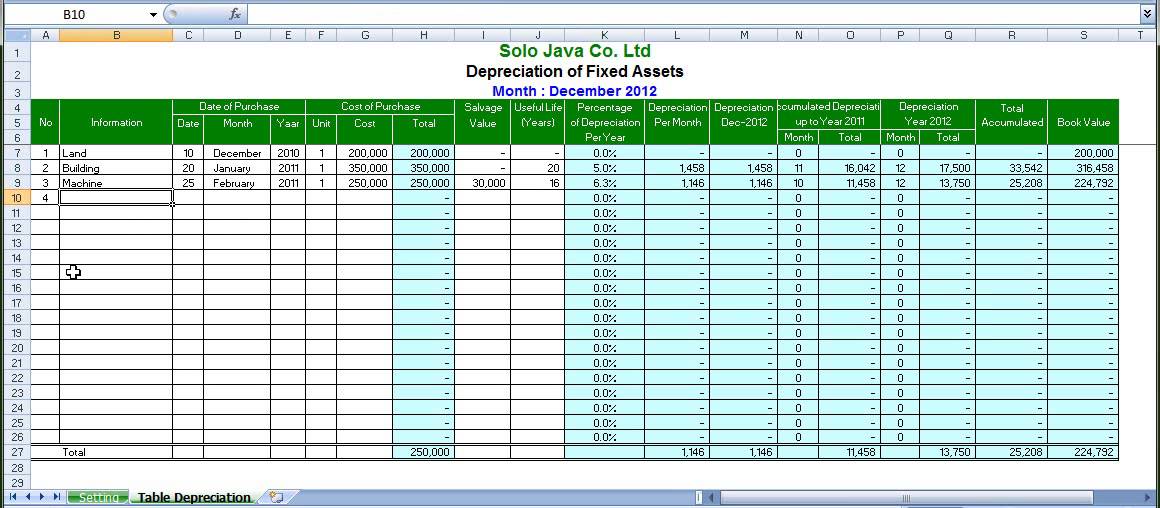

Web Depreciation Methods Template This depreciation methods template will show you the calculation of depreciation expenses using four types of commonly used depreciation Web A depreciation schedule is a table that shows the depreciation expense for an asset over its useful life The depreciation schedule records the

Depreciation Format In Excel

Depreciation Format In Excel

http://www.justanswer.com/uploads/jeydee/2006-12-10_012401_Clipboard01.jpg

Free Avery Template 5160 Charcot

https://soulcompas.com/wp-content/uploads/2020/09/fixed-asset-schedule-format-pdf.jpg

Depreciation Calculator Excel Template For Your Needs

https://www.fm-magazine.com/content/fmm-home/news/2018/dec/excel-offset-function-calculate-depreciation-201820044/_jcr_content/article/articleparsys/image_381478502.img.jpg/1544817197473.jpg

Web May 31 2021 nbsp 0183 32 To calculate the depreciation using the sum of the years digits SYD method Excel calculates a fraction by which the fixed asset should be depreciated Web Depreciation in Excel Excel provides several built in functions for calculating depreciation and amortization using various methods The different depreciation methods and the

Web Depreciation for the first and last periods is a special case For the first period DB uses this formula cost rate month 12 For the last period DB uses this formula cost total Web Start Free Written by CFI Team Straight Line Depreciation Template This straight line depreciation template demonstrates how to calculate depreciation expense using the

More picture related to Depreciation Format In Excel

Accumulated Depreciation Formula In Excel KarenaQuinn

https://www.dummies.com/wp-content/uploads/497483.image0.jpg

Depreciation Schedule Free Depreciation Excel Template

https://www.businessaccountingbasics.co.uk/images/straight-line-depreciation-min.jpg

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial

https://i.pinimg.com/originals/c9/0d/fa/c90dfa6ba06bbc78a3517275c7e8e721.png

Web Jan 21 2023 nbsp 0183 32 5 Excel Depreciation Functions You Need to Know SLN SYD DB DDB VDB Watch on In our example we will have a depreciating asset with a cost of 30 000 The residual value will be 3 000 and the Web Dec 27 2021 nbsp 0183 32 Excel supports various methods and formulas to calculate depreciation There 7 built in functions dedicated to depreciation calculation In this guide we re going to show you How to calculate

Web Download Depreciation Calculator Excel Template Depreciation Calculator is a ready to use excel template to calculate Straight Line as well as Diminishing Balance Web Oct 17 2023 nbsp 0183 32 Get FREE Advanced Excel Exercises with Solutions Depreciation is described as the continual lowering of a fixed asset s reported cost until the asset s

Depreciation Schedule Template 9 Free Word Excel PDF Format Download

https://images.template.net/wp-content/uploads/2015/10/19155259/Free-Download-Depreciation-Schedule-Template-in-Excel-Format.jpg

Straight Line Depreciation System By Excel YouTube

https://i.ytimg.com/vi/c9b_zLXxNaE/maxresdefault.jpg

Depreciation Format In Excel - {Web Jul 7 2016 nbsp 0183 32 For straight line depreciation you ll first need to fill in the Fixed Asset Information box in the top left just under the Zervant logo This includes The value of |Web Jun 19 2023 nbsp 0183 32 Using Formulas to Calculate Depreciation and Amortization in Excel Tips and Tricks for Accurate Calculation of Depreciation and Amortization in Excel Common | Web Feb 17 2023 nbsp 0183 32 Start date This is the date that we will begin to start depreciating the asset Formula EOMONTH A2 1 1 Result 2023 01 01 The EOMONTH formula in Excel is | Web May 31 2021 nbsp 0183 32 To calculate the depreciation using the sum of the years digits SYD method Excel calculates a fraction by which the fixed asset should be depreciated | Web Depreciation in Excel Excel provides several built in functions for calculating depreciation and amortization using various methods The different depreciation methods and the | Web Depreciation for the first and last periods is a special case For the first period DB uses this formula cost rate month 12 For the last period DB uses this formula cost total | Web Start Free Written by CFI Team Straight Line Depreciation Template This straight line depreciation template demonstrates how to calculate depreciation expense using the }