How To Build A Loan Payment Calculator In Excel WEB Apr 13 2022 nbsp 0183 32 Quick Links Calculate a Loan Payment in Excel Formula to Calculate an Interest Rate in Excel How to Calculate a Payment Term in Excel Optional Arguments for Loan Calculations Because of its functions and features Excel is a great application for budgeting along with managing your money

WEB Feb 7 2023 nbsp 0183 32 Thankfully Excel has made it easy for you to calculate loan payments for any type of loan or credit card Excel has a built in function PMT that calculates the monthly loan payments for you WEB Fortunately we have the Excel loan amortization calculator It lists out the entire repayment schedule in seconds You can either get the free online template or create your own loan calculator using the Excel PMT function

How To Build A Loan Payment Calculator In Excel

How To Build A Loan Payment Calculator In Excel

https://tunexp.com/wp-content/uploads/2021/12/Screenshot-2021-12-14-231558.jpg

28 Tables To Calculate Loan Amortization Schedule Excel Free

http://www.freetemplatedownloads.net/wp-content/uploads/2016/10/Loan-Amortization-Template-02.jpg

How To Create A Loan Payment Calculator In Excel YouTube

https://i.ytimg.com/vi/oSCpnOQdnOw/maxresdefault.jpg

WEB Jul 24 2023 nbsp 0183 32 With this Excel calculator template you can view a summary and amortization schedule with the final payment for your loan Enter the loan details including starting amount and date interest rate amortization period and number of WEB Feb 28 2024 nbsp 0183 32 Learn how to calculate all the particulars of a loan using Excel and how to set up a schedule of repayment for a mortgage or any other loan

WEB Mar 12 2024 nbsp 0183 32 Creating a mortgage calculator in Excel is easy even if you re not extremely comfortable with Excel One of the best features of Excel is its ability to calculate your mortgage related expenses like interest and monthly payments WEB This example teaches you how to create a loan amortization schedule in Excel 1 We use the PMT function to calculate the monthly payment on a loan with an annual interest rate of 5 a 2 year duration and a present value amount borrowed of 20 000

More picture related to How To Build A Loan Payment Calculator In Excel

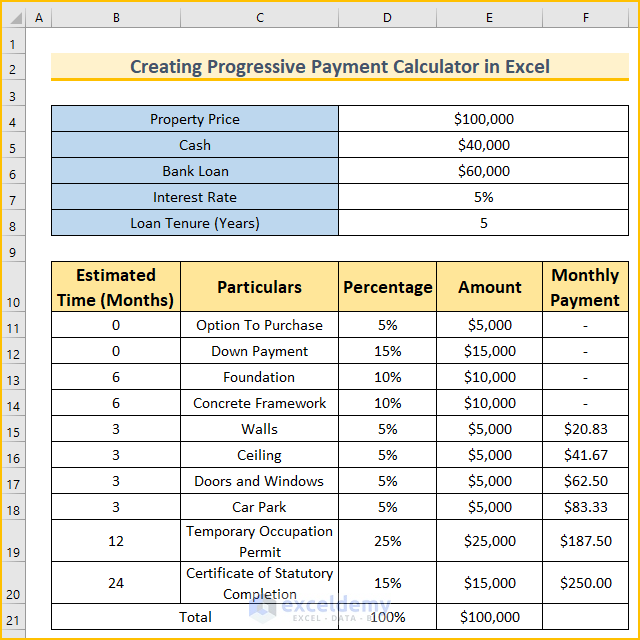

Create Progressive Payment Calculator In Excel with Easy Steps

https://www.exceldemy.com/wp-content/uploads/2022/10/Progressive-Payment-Calculator-Excel-6.png

What Is The Help To Build Loan Bell Lamb Joynson Solicitors

https://www.bljsolicitors.co.uk/wp-content/uploads/help-to-build-loan.jpg

LOAN BANK LOAN How To

https://i.ytimg.com/vi/BftoKL-r-34/maxresdefault.jpg

WEB May 2 2024 nbsp 0183 32 To create an amortization schedule in Excel begin by entering the loan amount interest rate and loan period into a new spreadsheet Then use financial functions to calculate the periodic payments and apply them over each period WEB May 20 2023 nbsp 0183 32 Creating an amortization schedule in Excel is a simple and effective way to manage your loan payments and stay on top of your finances By following the steps outlined in this article you can easily create your own schedule and make informed decisions about your loan

WEB Feb 8 2021 nbsp 0183 32 To calculate monthly payments for a loan using Excel you ll use a built in tool called the PMT function What Is the PMT Function in Excel The PMT function calculates monthly loan payments based on constant payments and a constant interest rate WEB Jul 6 2024 nbsp 0183 32 Method 1 Using the PMT Function to Calculate Loan Payments in Excel Steps Select a different cell C10 to keep the Monthly Payment Use the following formula in the cell PMT C7 C8 12 C5 Formula Breakdown

Mortgage Payment Table Spreadsheet Amortization Schedule Mortgage

https://i.pinimg.com/originals/f6/bb/06/f6bb06c3e01370987c6e5a20ea24cfb6.jpg

Loan Amortization Schedule Excel Template Shatterlion info

http://shatterlion.info/wp-content/uploads/2018/01/loan-amortization-schedule-excel-template-amortization-formula-excel-1024x630.jpg

How To Build A Loan Payment Calculator In Excel - {WEB Nov 6 2023 nbsp 0183 32 Do you have a loan and want to know your monthly payments Here s how to use the PMT function in Excel to easily calculate your payments |WEB Aug 9 2022 nbsp 0183 32 Home Mortgage Calculator If you want an easy way to view the schedule for your loan you can create an amortization table in Microsoft Excel We ll show you several templates that make creating this schedule easy so that you can track your loan | WEB Dec 5 2023 nbsp 0183 32 Excel is a powerful tool that can help you create a simple loan calculator to calculate monthly payments interest rates and total loan amounts With a few simple formulas and functions you can have a fully functional loan calculator at your fingertips | WEB Jul 24 2023 nbsp 0183 32 With this Excel calculator template you can view a summary and amortization schedule with the final payment for your loan Enter the loan details including starting amount and date interest rate amortization period and number of | WEB Feb 28 2024 nbsp 0183 32 Learn how to calculate all the particulars of a loan using Excel and how to set up a schedule of repayment for a mortgage or any other loan | WEB Mar 12 2024 nbsp 0183 32 Creating a mortgage calculator in Excel is easy even if you re not extremely comfortable with Excel One of the best features of Excel is its ability to calculate your mortgage related expenses like interest and monthly payments | WEB This example teaches you how to create a loan amortization schedule in Excel 1 We use the PMT function to calculate the monthly payment on a loan with an annual interest rate of 5 a 2 year duration and a present value amount borrowed of 20 000 }