New Depreciation Schedule In Excel Format Web Depreciation Schedule in Excel File Download Description using this Excel file u can easily calculate the Depreciation on Fixed assets under Companies Act as well as under Income Tax Act U may change the Rate of Depreciation amp can easily insert or delete rows as per ur requirements xls Submitted By

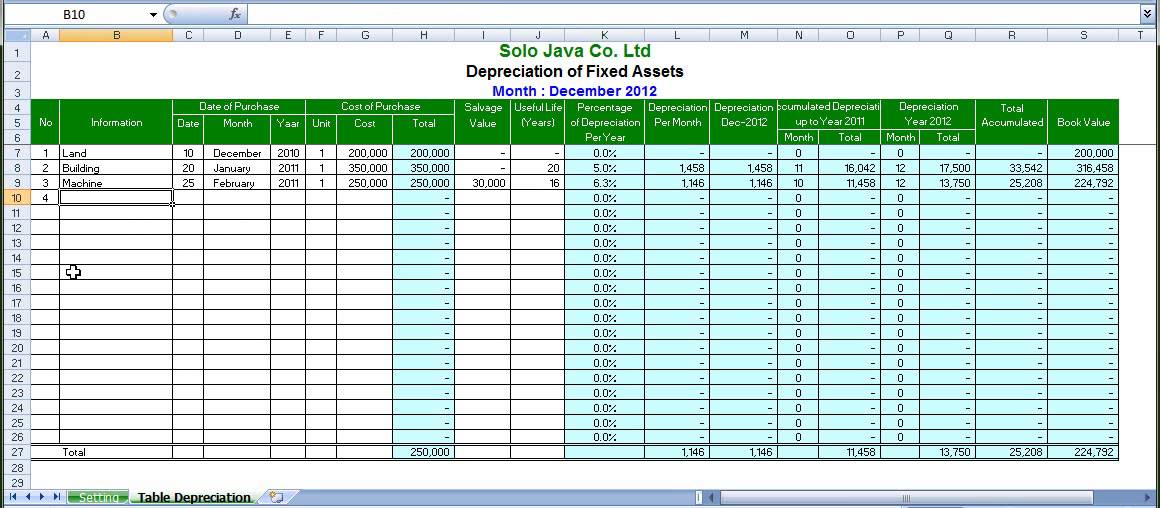

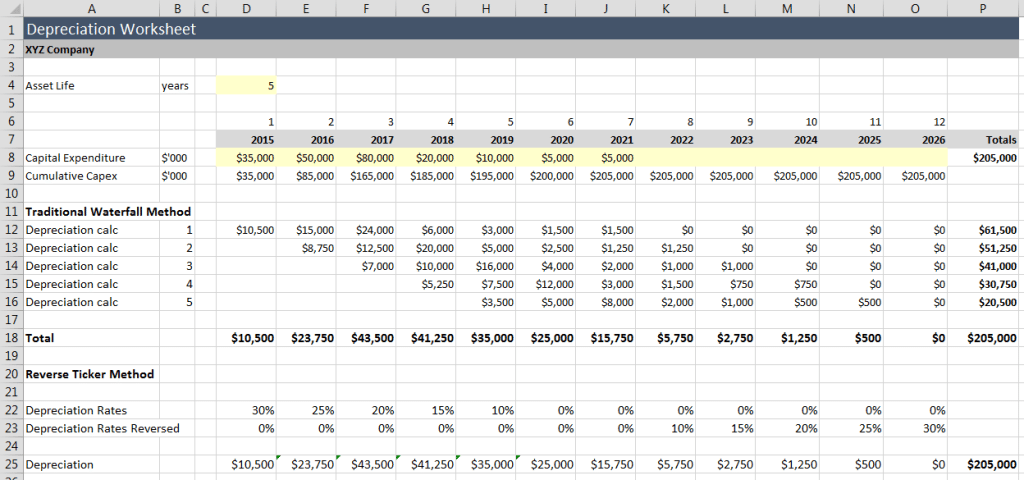

Web May 1 2021 nbsp 0183 32 The table below includes all the built in Excel depreciation methods included in Excel 365 along with the formula for calculating units of production depreciation These eight depreciation methods are discussed in two sections each with an Web Oct 26 2023 nbsp 0183 32 How to Calculate Monthly Depreciation Schedule in Excel 8 Quick Steps Step 1 Using Data Validation Tool to Insert Assets in Excel Step 2 Calculating Return Down Value at Starting Month of January Step 3 Evaluating the Current Value of Assets in Depreciation Schedule

New Depreciation Schedule In Excel Format

New Depreciation Schedule In Excel Format

https://www.template124.com/wp-content/uploads/2017/02/Fixed-Asset-Depreciation-Excel-1024x300.jpg

Depreciation Schedule Excel Emmamcintyrephotography

http://emmamcintyrephotography.com/wp-content/uploads/2018/07/depreciation-schedule-excel-maxresdefault.jpg

Depreciation Schedule Excel Template

https://i2.wp.com/www.allbusinesstemplates.com/thumbs/29f2f01a-ca09-4a84-b3e2-4ea6a4a8337b_1.png

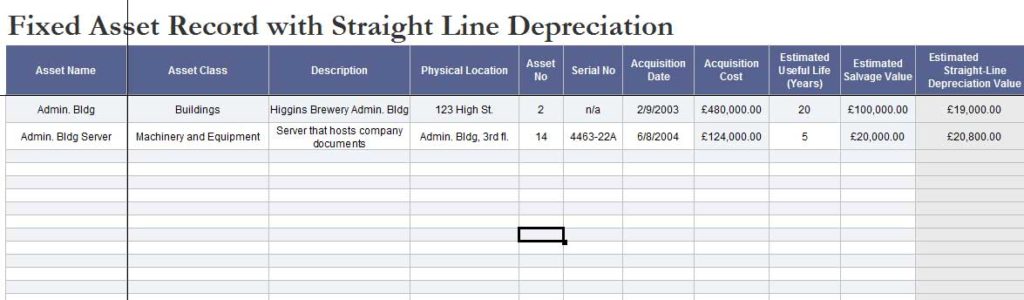

Web The depreciation schedule records the depreciation expense on the income statement and calculates the asset s net book value at the end of each accounting period Our Excel spreadsheet will allow you to track and calculate depreciation for up to 25 assets using the straight line method Web A depreciation schedule is required in financial modeling to forecast the value of a company s fixed assets balance sheet depreciation expense income statement and capital expenditures cash flow statement Depreciation occurs as an economic asset is used up Economic assets are different types of property plant and equipment

Web Feb 17 2023 nbsp 0183 32 In this article we will discuss how to create depreciation schedules in Excel including the different methods of depreciation how to use Excel formulas to calculate depreciation and how to customize the schedule to Web Create a tax depreciation schedule using Microsoft Excel from scratch In addition use the depreciation schedule for bookkeeping purposes These step by step instructions along with screenshots will walk you through the process

More picture related to New Depreciation Schedule In Excel Format

Tax Laptop Depreciation Calculator CeilidhFrankie

https://nerdcounter.com/wp-content/uploads/2021/07/depreciation-calculator.png

Business Depreciation Schedule Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/43cce951-5a4f-4023-bbfe-4c0e37eb494d_1.png

Irs Vehicle Depreciation Calculator BrookeNella

https://sharedeconomycpa.com/wp-content/uploads/2022/03/depreciation-schedule-example.jpg

Web Apr 26 2023 nbsp 0183 32 In the new addition sheet this new furniture Furniture4 is required to be selected for calculating depreciation on new additions Opening Balances Since the users must be having individual asset wise closing wdv as on 31 03 2022 the details required in the opening sheet should be filled using the wdv list as on 31 03 2022 Web Create a Depreciation Schedule in Excel from Scratch Download Now Fixed Assets Depreciation Schedule in Word Doc education ky gov Download Now Property Schedule Depreciation Calculator Download Now Building Depreciation Schedule Template PDF Download Download Now Free Depreciation Schedule for Rental Property Download

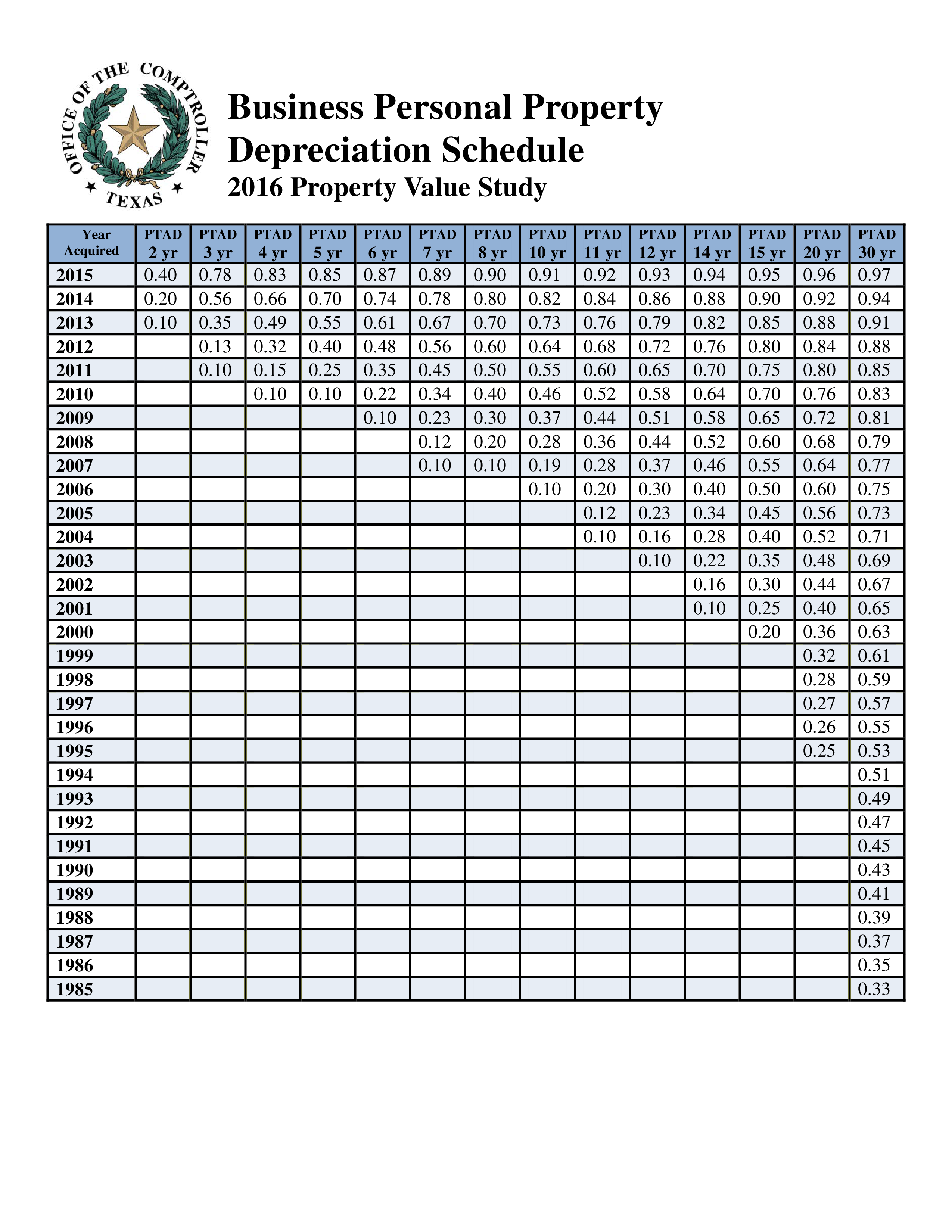

Web Mar 17 2016 nbsp 0183 32 The Calculator is in Excel Format and it helps in Calculating depreciation as per Rates Prescribed under Rule 5 of Income Tax Rules Read with Section 32 of Income Tax Act 1961 The Calculator is easy to use and determine depreciation rate and depreciation automatically Web How to make a depreciation schedule in Excel Download this Depreciation Schedule Template Excel Spreadsheet template now Whether you manage the finances at your work or at home adequate communication is essential and important

New Depreciation Schedule Template Excel Free exceltemplate xls

https://i.pinimg.com/736x/7e/a1/05/7ea105d2fdc9685e5b9a03938cb43f60.jpg

Depreciation Schedule Excel Emmamcintyrephotography

http://emmamcintyrephotography.com/wp-content/uploads/2018/07/depreciation-schedule-excel-deprecation-modelling-2-1024x480.jpg

New Depreciation Schedule In Excel Format - {Web May 29 2015 nbsp 0183 32 Depreciation as per schedule II in excel final Download Preview Description Hi This is updated excel sheet for calculating depreciation as per schedule II of companies act 13 xlsx Submitted By CA VIVEK JHA on 29 May 2015 Other files by the user Downloaded 3351 times File size 71 KB Rating 5 |Web Apr 1 2014 nbsp 0183 32 Excel Depreciation Calculator Companies Act 2013 Schedule II SLM WDV Depreciation Calculator FY 2015 16 Click Here gt gt Depreciation Calculator for FY 2014 15 What is New in Version 15 50 In version 15 50 an error showing more than 100 depreciation for double triple shift has been corrected | Web Depreciation Calculator is a ready to use excel template to calculate Straight Line as well as Diminishing Balance Depreciation on Tangible Fixed Assets The template displays the depreciation rate for the straight line method based on scrap value | Web The depreciation schedule records the depreciation expense on the income statement and calculates the asset s net book value at the end of each accounting period Our Excel spreadsheet will allow you to track and calculate depreciation for up to 25 assets using the straight line method | Web A depreciation schedule is required in financial modeling to forecast the value of a company s fixed assets balance sheet depreciation expense income statement and capital expenditures cash flow statement Depreciation occurs as an economic asset is used up Economic assets are different types of property plant and equipment | Web Feb 17 2023 nbsp 0183 32 In this article we will discuss how to create depreciation schedules in Excel including the different methods of depreciation how to use Excel formulas to calculate depreciation and how to customize the schedule to | Web Create a tax depreciation schedule using Microsoft Excel from scratch In addition use the depreciation schedule for bookkeeping purposes These step by step instructions along with screenshots will walk you through the process }