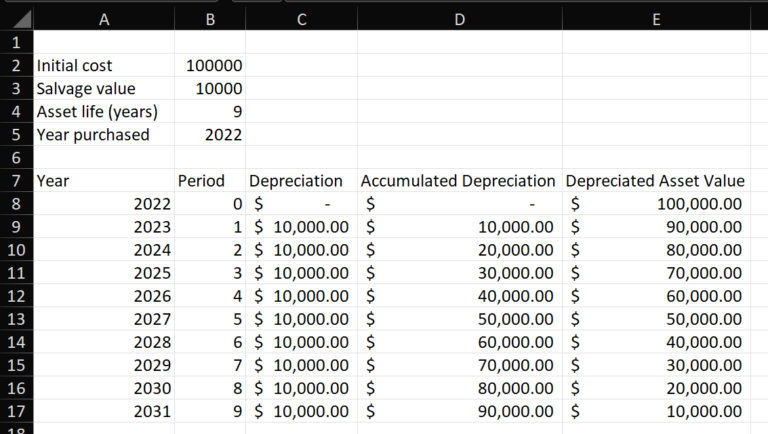

How To Set Up A Depreciation Schedule In Excel Web Oct 26 2023 nbsp 0183 32 How to Calculate Monthly Depreciation Schedule in Excel 8 Quick Steps Step 1 Using Data Validation Tool to Insert Assets in Excel Step 2 Calculating Return Down Value at Starting Month of January Step 3 Evaluating the Current Value of Assets in Depreciation Schedule

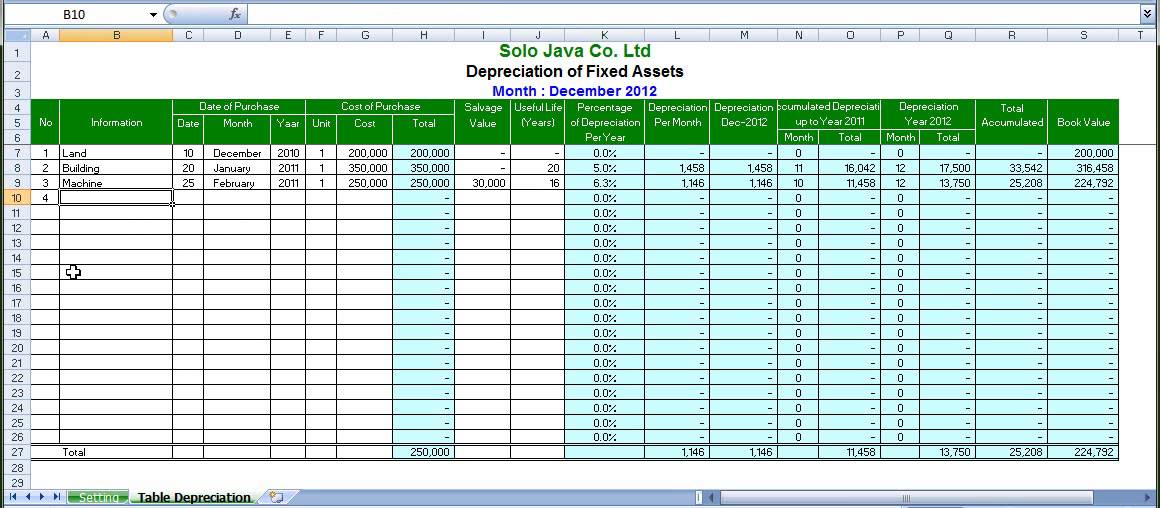

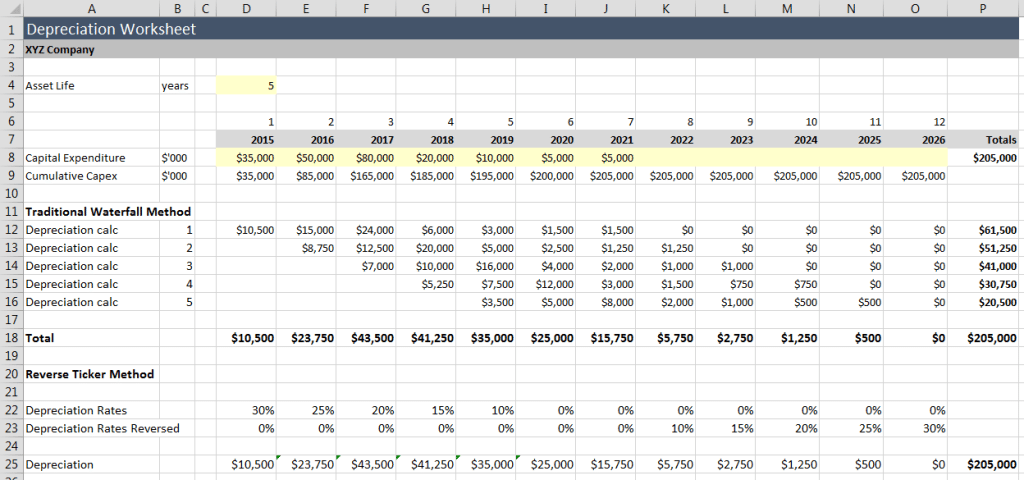

Web May 1 2021 nbsp 0183 32 The table below includes all the built in Excel depreciation methods included in Excel 365 along with the formula for calculating units of production depreciation These eight depreciation methods are discussed in two sections each with an Web The depreciation schedule records the depreciation expense on the income statement and calculates the asset s net book value at the end of each accounting period Our Excel spreadsheet will allow you to track and calculate depreciation for up to 25 assets using the straight line method

How To Set Up A Depreciation Schedule In Excel

How To Set Up A Depreciation Schedule In Excel

https://i.pinimg.com/736x/c7/58/ae/c758ae481523df3b8de6696b103db331.jpg

Excel lambda depn schedule Create A Depreciation Schedule In Excel

https://www.flexyourdata.com/wp-content/uploads/2022/08/depn1-768x434.png

Calculation Of Depreciation On Rental Property InnesLockie

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/07/20042010/OFFSET.jpg

Web Jun 1 2021 nbsp 0183 32 I demonstrate two methods for creating the depreciation schedule the first method works in any version of Excel The second method only works in Excel 365 and uses dynamic array formulas Web This Depreciation Schedule template provides a simple method for calculating total yearly depreciation for multiple assets For each asset choose between the Straight Line Sum of Years Digits Double Declining Balance or Declining Balance with

Web Dec 15 2020 nbsp 0183 32 Excel has a small selection of functions for various ways of calculating depreciation built in SLN The straight line function is the simplest SLN cost salvage life Cost is the cost of the asset Salvage is the salvage value of the asset Life is the number of periods over which the asset will be depreciated SLN just replicates the formula Web A depreciation schedule is required in financial modeling to forecast the value of a company s fixed assets balance sheet depreciation expense income statement and capital expenditures cash flow statement Depreciation occurs as an economic asset is used up Economic assets are different types of property plant and equipment

More picture related to How To Set Up A Depreciation Schedule In Excel

Depreciation Schedule Excel Emmamcintyrephotography

http://emmamcintyrephotography.com/wp-content/uploads/2018/07/depreciation-schedule-excel-maxresdefault.jpg

How To Prepare Depreciation Schedule In Excel YouTube

https://i.ytimg.com/vi/dVKREQ4PejI/maxresdefault.jpg

8 Ways To Calculate Depreciation In Excel 2023

https://www.journalofaccountancy.com/content/jofa-home/issues/2021/may/how-to-calculate-depreciation-in-excel/_jcr_content/contentSectionArticlePage/article/articleparsys/image_395166678.img.jpg/1619556101141.jpg

Web Aug 13 2010 nbsp 0183 32 Create a tax depreciation schedule using Microsoft Excel from scratch In addition use the depreciation schedule for bookkeeping purposes These step by step instructions along with screenshots will walk you through the process Web The SLN Straight Line function is easy Each year the depreciation value is the same The SLN function performs the following calculation Deprecation Value 10 000 1 000 10 900 00 If we subtract this value 10 times the asset depreciates from 10 000 to 1000 in 10 years see first picture bottom half SYD

Web May 31 2021 nbsp 0183 32 To calculate the depreciation using the sum of the years digits SYD method Excel calculates a fraction by which the fixed asset should be depreciated using years left of useful life 247 Web 8 ways to calculate depreciation in Excel Journal of Accountancy Depreciation Schedule An first section explains straight line sum of years digits declining balance both double declining balance impairment The second section covers the remaining depreciation methods This site uses cakes the retail information on your computer

8 Ways To Calculate Depreciation In Excel 2023

https://www.journalofaccountancy.com/content/jofa-home/issues/2021/may/how-to-calculate-depreciation-in-excel/_jcr_content/contentSectionArticlePage/article/articleparsys/image_1279062703.img.jpg/1619556227814.jpg

Depreciation Schedule Excel Emmamcintyrephotography

http://emmamcintyrephotography.com/wp-content/uploads/2018/07/depreciation-schedule-excel-deprecation-modelling-2-1024x480.jpg

How To Set Up A Depreciation Schedule In Excel - {Web Dec 6 2010 nbsp 0183 32 As the industry standard for spreadsheet software Microsoft Excel comes with many advantages to the new user Professional Investment Banking and Research A |Web Dec 27 2021 nbsp 0183 32 Excel has the DB function to calculate the depreciation of an asset on the fixed declining balance basis for a specified period The function needs the initial and salvage costs of the asset its useful life and the period data by default Additionally you have an option to supply a month number in case the first year is partial | Web How to prepare Assets schedule in Microsoft Excel This video helps you to understand that how to make a spread sheet of Depreciation amp accumulated depreciati | Web Jun 1 2021 nbsp 0183 32 I demonstrate two methods for creating the depreciation schedule the first method works in any version of Excel The second method only works in Excel 365 and uses dynamic array formulas | Web This Depreciation Schedule template provides a simple method for calculating total yearly depreciation for multiple assets For each asset choose between the Straight Line Sum of Years Digits Double Declining Balance or Declining Balance with | Web Dec 15 2020 nbsp 0183 32 Excel has a small selection of functions for various ways of calculating depreciation built in SLN The straight line function is the simplest SLN cost salvage life Cost is the cost of the asset Salvage is the salvage value of the asset Life is the number of periods over which the asset will be depreciated SLN just replicates the formula | Web A depreciation schedule is required in financial modeling to forecast the value of a company s fixed assets balance sheet depreciation expense income statement and capital expenditures cash flow statement Depreciation occurs as an economic asset is used up Economic assets are different types of property plant and equipment }