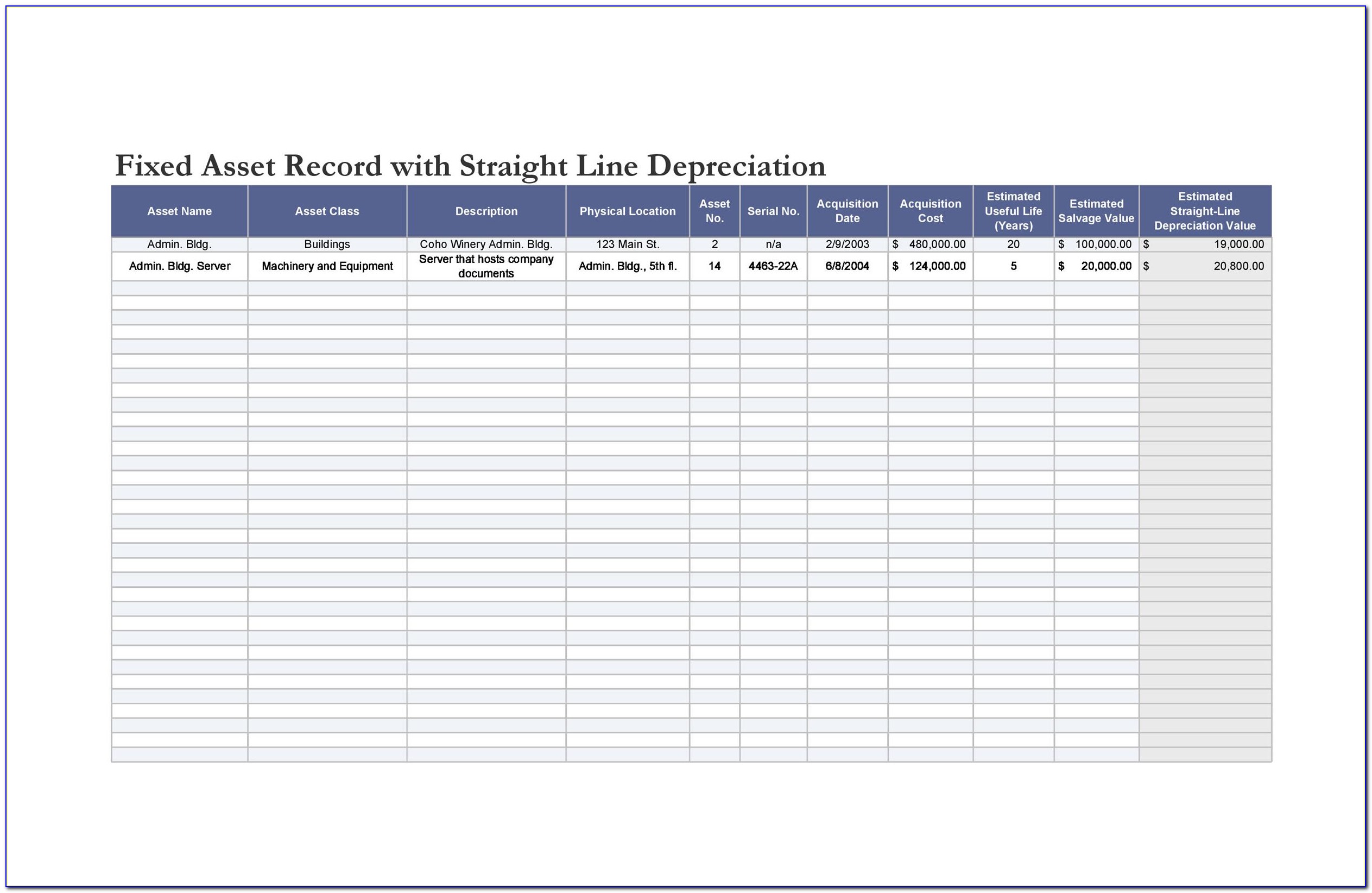

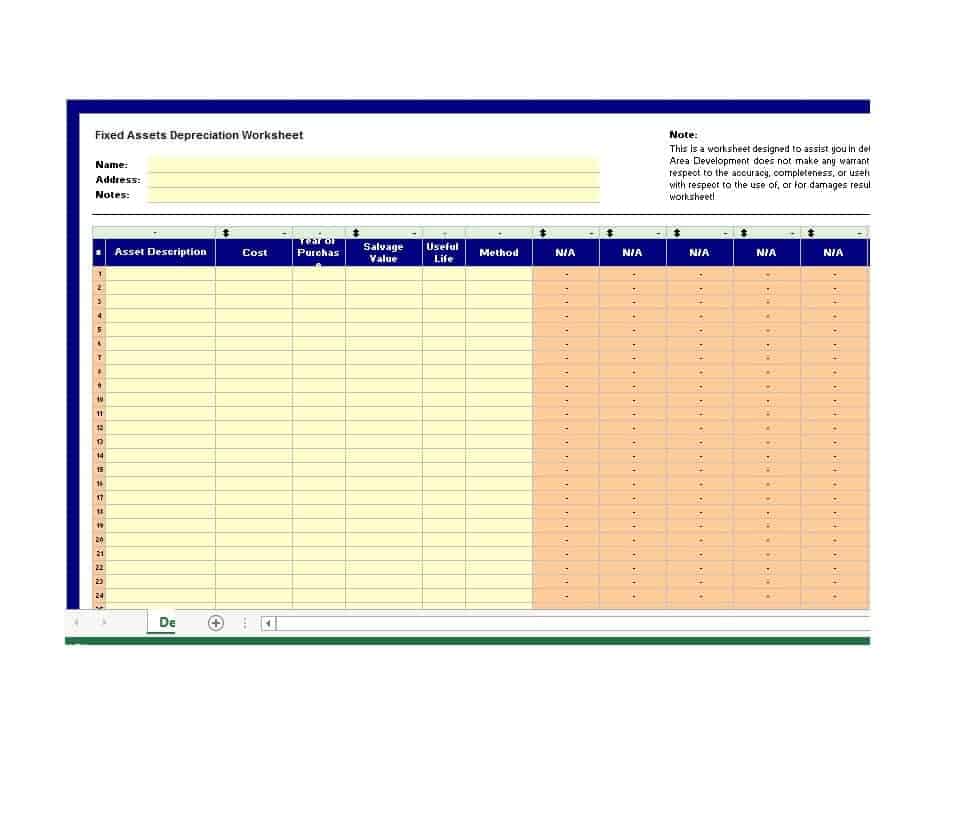

Depreciation Schedule Format In Excel WEB The depreciation schedule records the depreciation expense on the income statement and calculates the asset s net book value at the end of each accounting period Our Excel spreadsheet will allow you to track and calculate depreciation for up to 25 assets using the straight line method

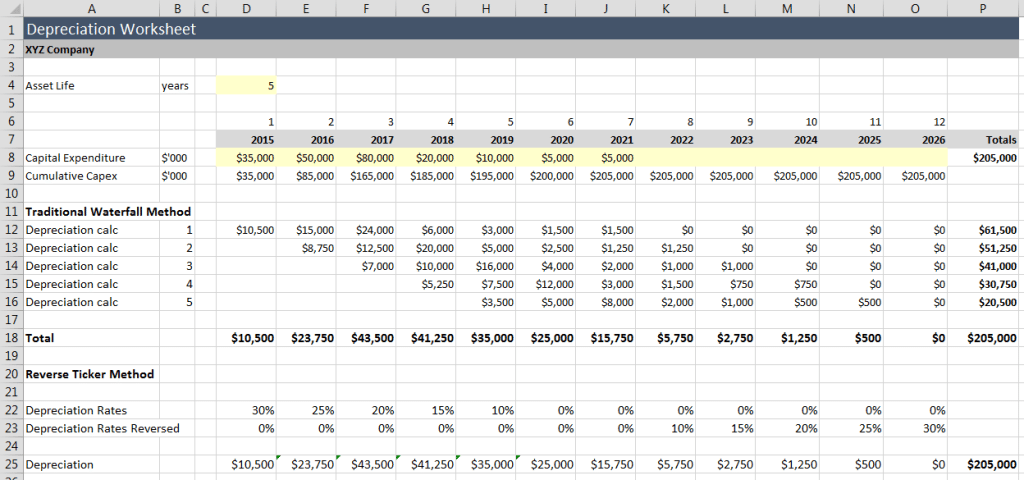

WEB Jul 4 2024 nbsp 0183 32 How to Create a Monthly Depreciation Schedule in Excel 8 Quick Steps In the following dataset you can see the Assets Purchase Date Actual Cost Salvage Value and Depreciations Rate columns Step 1 Using WEB May 1 2021 nbsp 0183 32 The table below includes all the built in Excel depreciation methods included in Excel 365 along with the formula for calculating units of production depreciation These eight depreciation methods are discussed in two sections each with an accompanying video

Depreciation Schedule Format In Excel

Depreciation Schedule Format In Excel

https://cdn.vertex42.com/ExcelTemplates/Images/depreciation-schedule.gif

Depreciation Schedule Excel Emmamcintyrephotography

http://emmamcintyrephotography.com/wp-content/uploads/2018/07/depreciation-schedule-excel-deprecation-modelling-2-1024x480.jpg

Free Depreciation Schedule Template FREE PRINTABLE TEMPLATES

https://www.businessaccountingbasics.co.uk/images/straight-line-depreciation-min.jpg

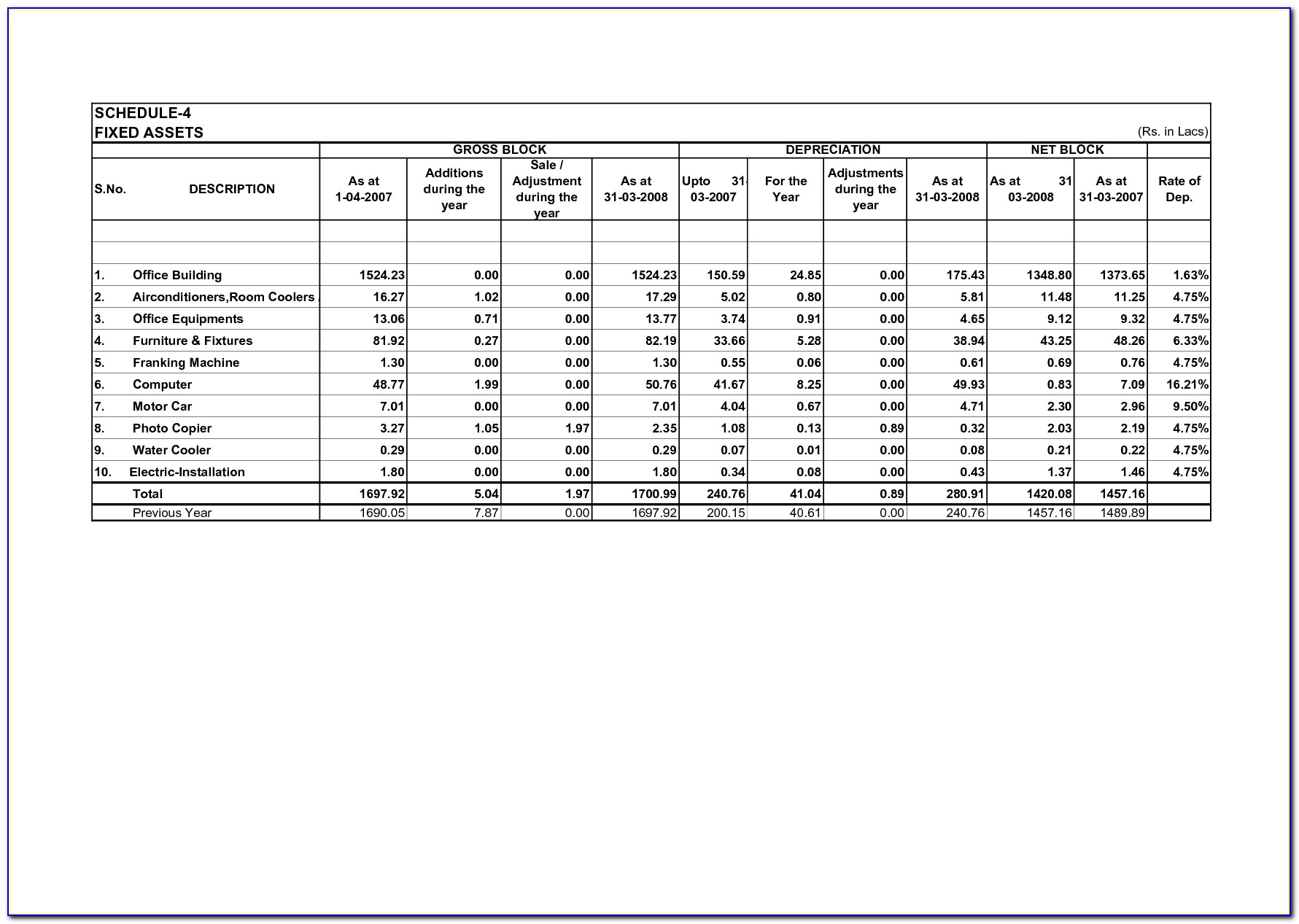

WEB Mar 5 2024 nbsp 0183 32 In this article we ll teach you how to make a depreciation worksheet in Excel from assembling column headers to entering formulas and explain the usage and arguments in each depreciation formula We ve also prepared a downloadable depreciation worksheet template that s ready to use WEB To calculate the annual depreciation value you can use the SLN function which requires three pieces of data the initial cost of the asset the salvage cost at the end of its useful life and the

WEB This straight line depreciation template demonstrates how to calculate depreciation expense using the straight line depreciation method WEB Apr 10 2020 nbsp 0183 32 This Excel Fixed Assets Depreciation Schedule automates the tracking of the balance of your fixed assets and record your depreciation expense on a straightline basis based on the number of

More picture related to Depreciation Schedule Format In Excel

Free Avery Template 5160 Charcot

https://soulcompas.com/wp-content/uploads/2020/09/fixed-asset-schedule-format-pdf.jpg

Depreciation Schedule Template Excel Free Printable Schedule Template

https://www.printablescheduletemplate.com/wp-content/uploads/2018/05/depreciation-schedule-template-excel-free-format-cells-in-excel-VAephw.jpg

Depreciation Schedule Template Excel Free Templates Printable Download

https://soulcompas.com/wp-content/uploads/2020/09/fixed-asset-depreciation-schedule-excel-template.jpg

WEB Jul 16 2019 nbsp 0183 32 This straight line depreciation schedule calculator uses Excel to produce a depreciation schedule based on asset cost salvage value and depreciation rate WEB Dec 27 2021 nbsp 0183 32 Excel has the DB function to calculate the depreciation of an asset on the fixed declining balance basis for a specified period The function needs the initial and salvage costs of the asset its useful life and the period data by default

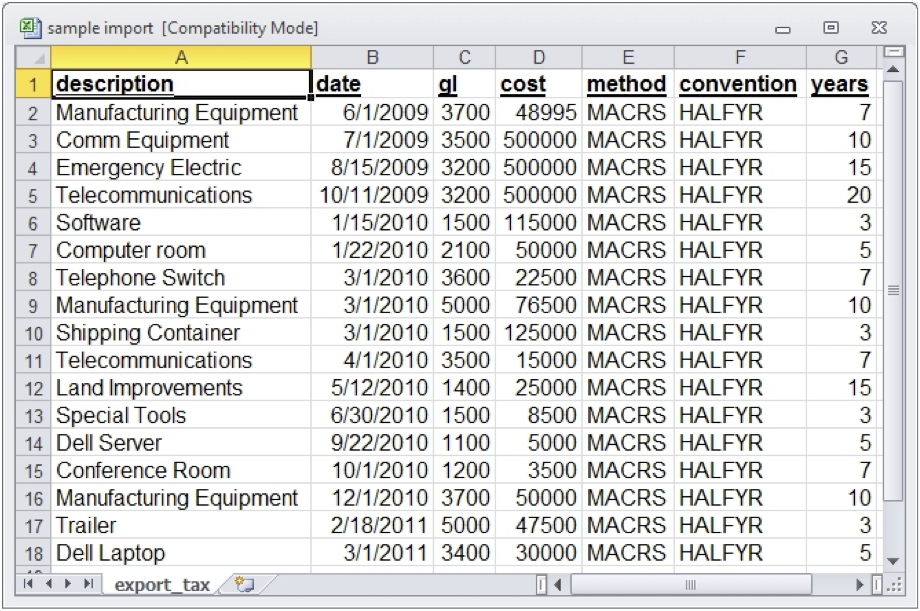

WEB Download our Depreciation Schedule Excel Template to easily track and calculate asset depreciation Ideal for accountants and businesses this template supports multiple depreciation methods auto generates schedules and provides detailed annual summaries WEB Create a tax depreciation schedule using Microsoft Excel from scratch In addition use the depreciation schedule for bookkeeping purposes These step by step instructions along with screenshots will walk you through the process

Practical Of Straight Line Depreciation In Excel 2020 YouTube

https://i.ytimg.com/vi/jf5JhKFh0Zg/maxresdefault.jpg

Depreciation Schedule Template Excel Free For Your Needs

https://www.wordexcelsample.com/wp-content/uploads/2019/08/iii-depreciation-schedule-template-14.jpg

Depreciation Schedule Format In Excel - {WEB In this article you ll find a collection of free Simple Depreciation Schedule Templates amp Samples in PDF Word and Excel format to help you make your document effective |WEB Jul 5 2024 nbsp 0183 32 How to Calculate Straight Line Depreciation Using Formula in Excel How to Use WDV Method of Depreciation Formula in Excel How to Apply Declining Balance Depreciation Formula in Excel Calculate Sum of Years Digits Depreciation with Formula in Excel Units of Production Depreciation Method with Formula in Excel | WEB The Depreciation Calculator is a readily available Excel template designed to compute Straight Line and Diminishing Balance Depreciation on Tangible or Fixed Assets This tool offers a comprehensive solution for accurately determining the depreciation rates and schedules associated with these methods | WEB Mar 5 2024 nbsp 0183 32 In this article we ll teach you how to make a depreciation worksheet in Excel from assembling column headers to entering formulas and explain the usage and arguments in each depreciation formula We ve also prepared a downloadable depreciation worksheet template that s ready to use | WEB To calculate the annual depreciation value you can use the SLN function which requires three pieces of data the initial cost of the asset the salvage cost at the end of its useful life and the | WEB This straight line depreciation template demonstrates how to calculate depreciation expense using the straight line depreciation method | WEB Apr 10 2020 nbsp 0183 32 This Excel Fixed Assets Depreciation Schedule automates the tracking of the balance of your fixed assets and record your depreciation expense on a straightline basis based on the number of }